Summary description of the Company

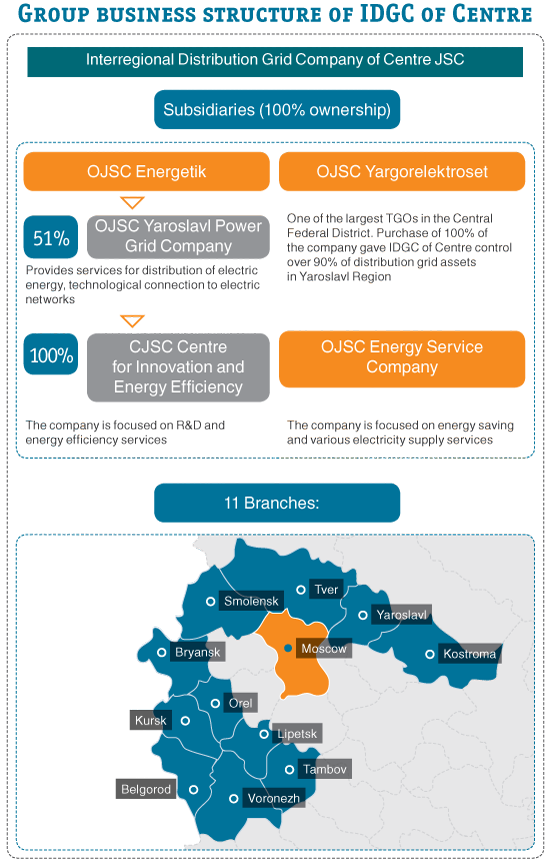

IDGC of Centre, JSC was established in 2004 and carries out its activities in the territory of 11 regions through the network of local branches. The Company includes also 3 subsidiaries and affiliates: Joint-Stock Company “Yaroslavl city power networks” (Yargorelektoset), Joint-Stock Company “Energetik”, and Open Joint Stock Company “Energy Service Company” established in the beginning of 2011.

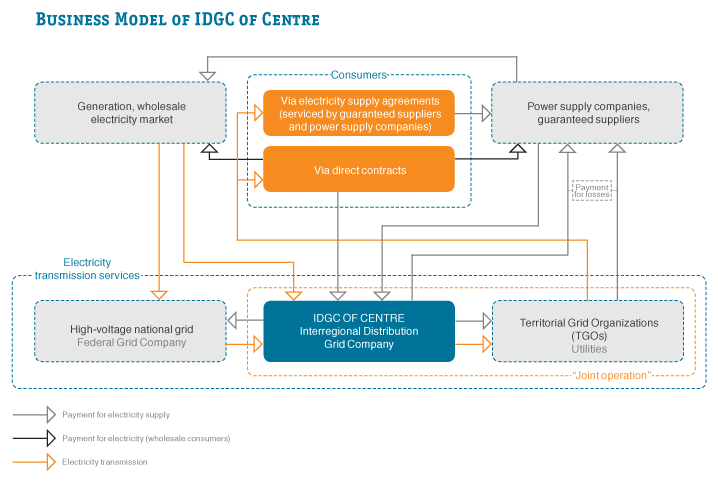

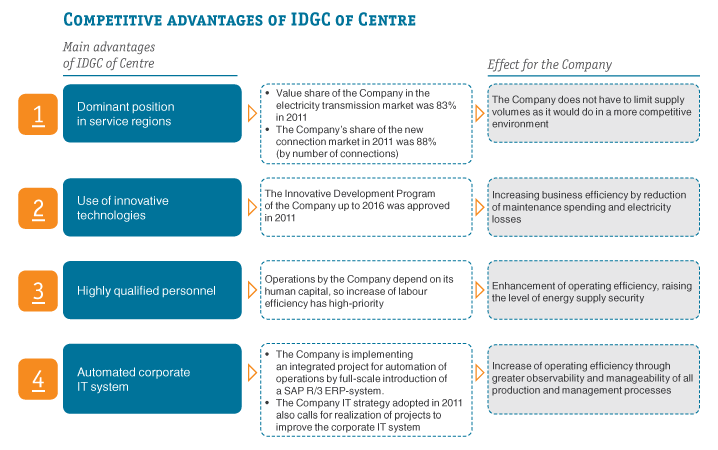

The Company holds a monopolistic position in the basic activities in the territory of presence: share on the market of electric power transmission (in money terms) amounted to 82.9%, on the market of technological connection – about 88% (in conversion to nominal units). Electrical supply from the network to the consumers and co-operating TGOsTerritorial Grid Organisation in 2011 amounted to 56.7 billion kWhkilowatt-hour and losses – 9.93%. Number of employees of the Company is about 31 thousand persons.

Revenue of IDGC of Centre, JSC for 2011 amounted to 68.13 billion rubles, which is 12.8% higher than the 2010 revenue. Net profit amounted to 5.20 billion rubles, representing 10.4% increase comparatively to 2010; EBITDA amounted to 13.82 billion rubles, representing 26.1% increase; net asset value as of the end of the year amounted to 50.51 billion rubles.

Investment programme of 2011 was implemented by 15.2 billion rubles. Moreover, new construction and expansion was financed in the amount of 6.6 billion rubles, technical upgrading and reconstruction – 8.5 billion rubles. 4,630 km of the power lines and 1,490 MVAMegavolt-Ampere. Unit of measurement of electrical capacity of transformer capacity were put into operation in the reporting year.

As of December 31, 2011 capitalization of IDGC of Centre, JSC amounted to 25.15 billion rubles. JSC “IDGC Holding” is the controlling shareholder of the Company with the share of 50.23% of the registered capital. Shares of the Company are included into the “A” quotation list of the second level of the MICEX stock exchange and are included into the computation of the following indexes: MICEX PWR, MICEX SC, RTSeu, RTS-2.

In 2009, IDGC of Centre, JSC among the first Russian energy companies commenced the transition to the new system for RAB-based regulation in the regions of its presence. In 2011, the 4 remaining branches and “Yargorelektroset”, JSC, the subsidiary of the Company, shifted to RAB-regulation.

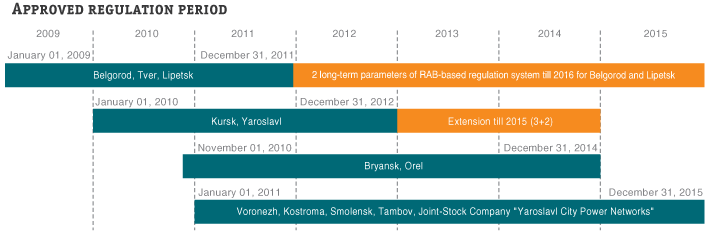

Schedule for switch of branches of IDGC of Centre, JSC to RAB-regulation:

Return on invested capital method RAB (Regulatory Asset Base) represents the system of tariff formation on the basis of the long-term rate regulation focused on attraction of investments for construction and modernization of the network infrastructure and stimulation of enhancement of the network organizations expenditure efficiency.

Amount of the invested capital of IDGC of Centre, JSC (inclusive of “Yargorelektroset”, JSC) equals to 118 billion rubles (average revaluation coefficient ~2.4). Fair estimate was performed by the Consortium of Independent Assessors which includes ZAO Deloitte & Touche CIS.

Three branches of the Company in Belgorod region, Lipetsk region and Tver region shifted to this tariff formation system from 2009, “Kurskenergo” and “Yarenergo” branches – from January 2010, “Bryanskenergo” and “Orelenergo” – from November 2010, and branches in Voronezh region, Kostroma region, Smolensk region and Tambov region, as well as 100% subsidiary Joint-Stock Company “Yaroslavl city power networks” – from January 2011.

Objects and results of transfer to RAB

Objects of the return on invested capital method (RAB):

- ensures transparent relationships between consumers, shareholders (investors) and the Company;

- tariffs are established for a long-term (3–5 years) regulation period;

- creation of stimulation for enhancement of efficiency of the Company’s operating activities;

- provision of possibility to return funds invested in the assets and acquisition of income.

Results of implementation of RAB:

- additional capacities of electric networks for connection;

- improvement of service quality and reliability of electric power supply;

- load in the tariff upon the return on investments is distributed in the long-term period;

- inflow of additional investments to the region;

- gain of returns at higher rates.

| Term | Commissioning of fixed assets, RUB, bn | Commissioning of capacities to the fixed assets | |

|---|---|---|---|

| km | MVA | ||

| 2009 | 7.7 | 2,414 | 877 |

| 2010 | 10.0 | 4,155 | 1,050 |

| 2011 | 13.9 | 4,630 | 1,490 |