Profit and Loss Statement

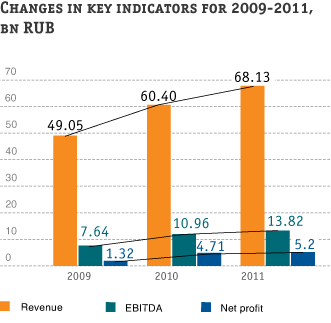

Throughout 2009-2011, positive growth in all financial and economic indicators has been visible at IDGC of Centre, JSC . Thus, in the period from 2009-2011 the Company’s revenue grew 17.8% a year on average, while net profit grew an average 98.2% a year and EBITDAEarnings Before Interest, Tax, Depreciation and Amortisation; indicator showing the profit of the Company before deduction of income taxes, accrued interest on loans and depreciation 34.6% a year. Equity capital increased by 11.4% on average in 2009-2011. The 2011 reporting year was no exception, and this positive trend in the Company’s financial indicators and performance continued.

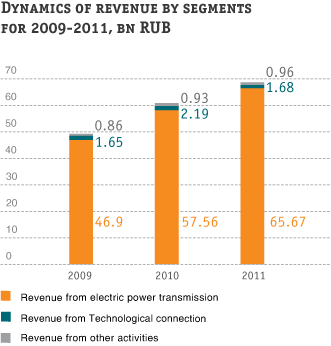

In 2011, the Company’s revenue grew 12.8% year-on-year, rising to RUB 68.13 bn. The Company’s year-end net profit was RUB 5.20 bn, or 10.4% higher than in 2010. The 2011 EBITDA figure was RUB 13.82 bn, a growth since 2010 of about RUB 2.86 bn or 26.1%. This growth is primarily the financial result of our primary form of activity, electric power transmission.

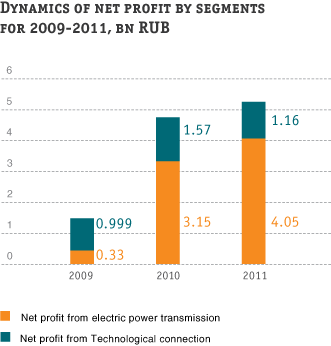

The increase in tariffs for electric power transmission (the weighted average “joint operation” tariff increased by 13.8% in comparison with 2010) and the increase of productive electric power supply (by 1.14% in comparison with 2010) resulted in a 2011 growth of revenue for electric power transmission services. This, in its turn, was reflected in increased net profit for this type of activity in the reporting year.

Reduction of net profit from Technological connection by RUB 411 mn in comparison with 2010 resulted from reduction in revenue from this type of activity. This, in its turn, was partially caused by performance in 2010 of a major agreement with Ministry of Commerce and Industry of the Russian Federation for Technological connection of energy receiving facilities (with capacity up to 12.35 MWMegawatt) of the chemical weapon destruction facility (facility 1729 “CWD” for I, II and III stages).

Reduction in revenue from Technological connection along with increase in attached capacity is also connected with the switch of IDGC of Centre, JSC to RABRegulatory Asset Base. Return on invested capital method. The basic principle of the method is ensuring of return of funds invested into the Company’s assets over a specified period and the receipt of the standardized level of income regulation which resulted in revision of tariff solutions of REC (Regional Energy Commission). Under the influence of this factor, as well as due to change of expenses for development of existing infrastructure from the tariff on Technological connection to the tariff on electric power transmission the average rate of payment for Technological connection in the territory of activities of IDGC of Centre, JSC in 2011 decreases on 42.5% in comparison with the previous year.

Dynamics of key financial indicators for 2009-2011, bn RUB :

| Indicator | 2009 | 2010 | 2011 | Growth rate, % | |

|---|---|---|---|---|---|

| 2010/2009 | 2011/2010 | ||||

| Revenue, bn RUB | 49.05 | 60.40 | 68.13 | 23 | 12.8 |

| Including: | |||||

| from electric power transmission | 46.9 | 57.56 | 65.67 | 23.1 | 14.1 |

| from Technological connection | 1.65 | 2.19 | 1.68 | 32.8 | -23.3 |

| Production costs, bn RUB | 43.26 | 50.88 | 55.48 | 18 | 9 |

| Gross profit, bn RUB | 5.796 | 9.52 | 12.65 | 64 | 33 |

| EBITDA, bn RUB | 7.64 | 10.96 | 13.82 | 43 | 26.1 |

| Net profit, bn RUB | 1.32 | 4.71 | 5.20 | 256 | 10.4 |

| Including: | |||||

| from electric power transmission | 0.33 | 3.15 | 4.05 | 867 | 29 |

| from Technological connectionValue of liabilities for Technological connection are included in the financial statement under the heading of net profit. | 0.999 | 1.57 | 1.16 | 57 | -26 |

The 2011 operating results show that, IDGC of Centre, JSC earned a net profit of RUB 5.203 bn. The Board of Directors of the Company intends to recommend to the Annual General Meeting of Shareholders of IDGC of Centre, JSC to distribute the net profit of the reporting year in the following manner:

Directions of distribution of profit of IDGC of Centre, JSC earned in 2011:

| Directions of distribution of profit | RUB 000. | |

|---|---|---|

| Retained profit (loss) of the reporting period: | 5,203,492 | |

| To distribute as follows: | ||

| Provision | 0 | |

| Profit for development | 4,781,313 | |

| Dividends | 422,179 | |

| Undistributed deficits of prior years | 0 | |